Climate, Covid, war: We are currently living in times of multiple crises that not only affect us personally, but also pose new challenges for companies. Project portfolio management is one of the most important levers that an organization has to respond to such challenges and to ensure its “survival” in these times, while paving the way for a successful future. This article provides an overview of the possible approaches, measures, and procedures in project portfolio management to cope with a crisis.

Approaches to crises in project portfolio management

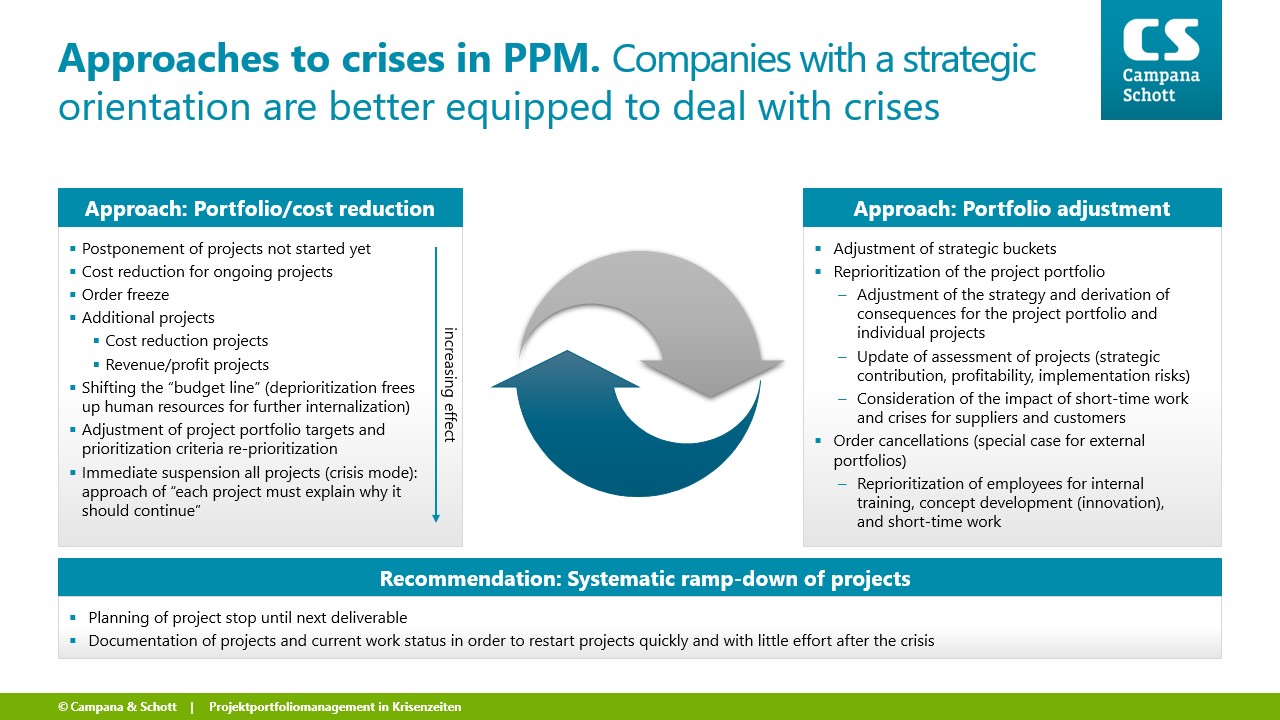

There are two basic approaches in project portfolio management for dealing with crises: portfolio or cost reduction and portfolio adjustment (see Figure 1). These approaches can be combined with different weightings. As experience from past crises shows, companies are more likely to emerge as winners if they not only reduce costs, but also strategically adjust their project portfolio with a focus on innovation.

Portfolio/cost reduction

For portfolio/cost reduction, the following measures are available listed here in order of increasing effect based on the experience collected from numerous consulting mandates (see left-hand box in Figure 1):

- Postponement of projects not started yet: Projects included in project portfolio planning are postponed until the following period.

- Cost reduction for ongoing projects: Budget reductions can be made in the form of across-the-board cuts (e.g. 10% of the project budget), the analysis of planned, actual, and forecast values (reduction of budget to forecast value, e.g. if the planned value is greater than the forecast value), or content-based cuts to the scope, although only the last two measures are recommended.

- Order freeze: Companies can reduce costs in the short term by having a central unit approve expenditures on all projects – typically orders for external services – only after individual evaluation and in urgent cases.

- Additional projects: New projects can be launched to achieve cost reductions in the organization or higher revenues/profits in the short term.

- Budget line shift: The budget line indicates which projects can be carried out with the existing project portfolio budget according to their prioritization. If the project portfolio budget is reduced, the least important projects included in the current project portfolio are deprioritized and halted. In most cases, the discontinuation of a project frees up human resources, who can then assist with other projects or replace external service providers. This further reduces costs.

- Adjustment of project portfolio targets and prioritization criteria: The objectives of the project portfolio and thus also the prioritization criteria and their weighting are geared towards profitability and cost reduction. This results in a reprioritization and even a new project sequence.

- Immediate suspension of all projects (maximum crisis mode): Following a general suspension of projects, each project management team must explain to a central committee why its project should continue under the new circumstances.

An important tip from practice: For all measures that can result in the termination of a project, those in charge should consider what, in the scope of a systematic ramp-down, the next deliverable is in the course of the project and what benefits or expenditure result from it. On this basis, they can decide whether to stop the project immediately or after the next deliverable has been made available. Here, it is recommended not to cease work immediately, but first to document the project and its latest status so that it can be restarted quickly and with little effort once the crisis is over.

Here are examples of how companies have responded in the past:

A company that was severely affected by a crisis initiated a program to reduce the cash-out. This included an immediate ban on orders for most projects. In addition, the management of the project portfolio essentially focused on cash flow. In terms of the project portfolio, the result was that only “must-do” projects were continued. Even the must-do projects were subjected to a further selection process with more stringent criteria for “must-do” projects.

In another company, the majority of projects were discontinued. Only projects with scheduled for completion in the short term and those that would have a positive impact on EBIT by the end of the year were continued.

Portfolio adjustment

There are three distinctive approaches within portfolio adjustment (see right-hand box in Fig. 1):

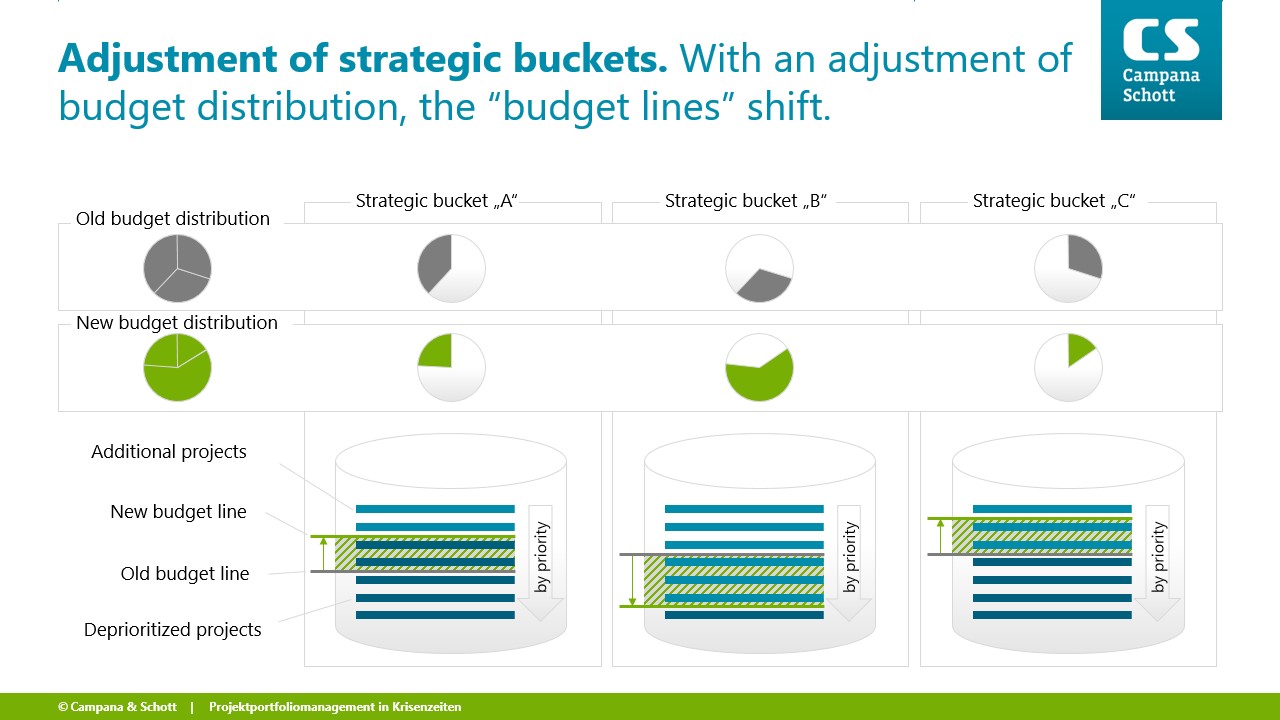

- Adjustment of strategic buckets (see Figure 2): Strategic buckets define where the budget should go for specific project categories in a project portfolio. They can be organized according to growth, innovation, and efficiency projects, to name a few examples. Strategic buckets are formed at the beginning of the project portfolio planning process in order to later prioritize the projects assigned to them. In existing strategic buckets, the budget distribution and thus the shift of the budget line within each bucket can be used to adjust the project portfolio to the new situation. This shifting of budgets to efficiency projects is therefore a way to take crisis situations into account.

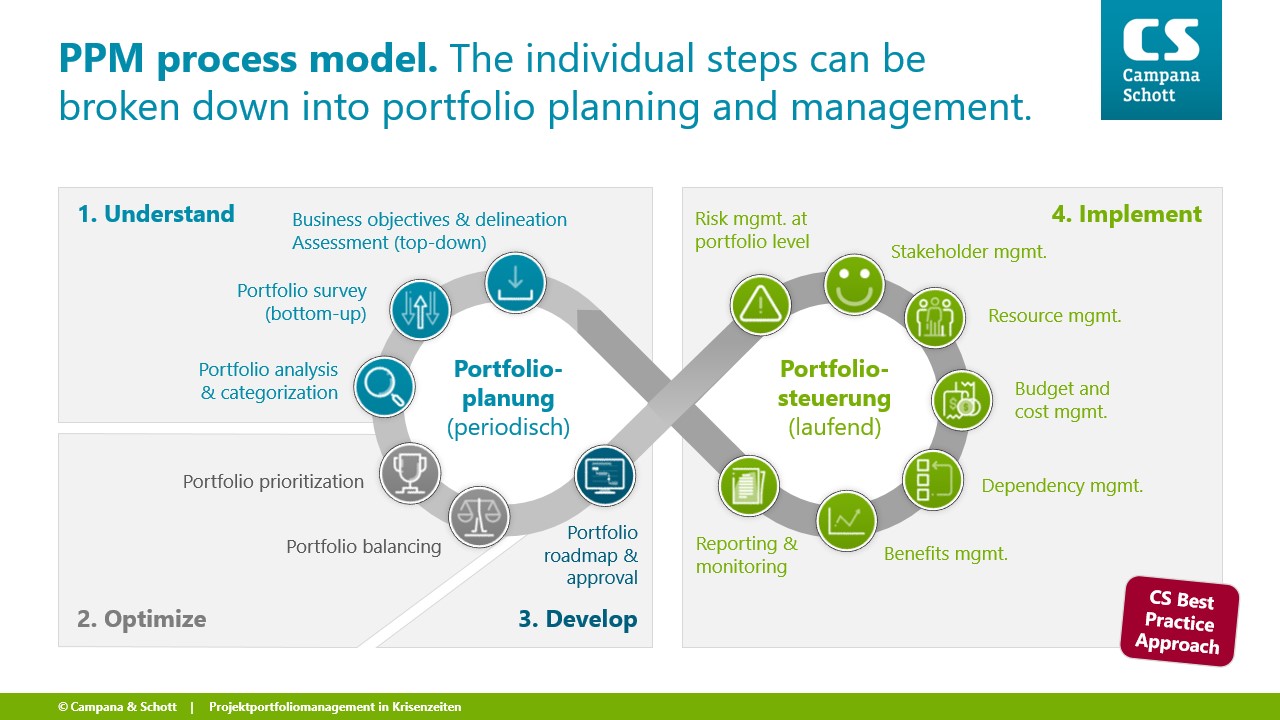

- Reprioritization of the project portfolio (according to project portfolio planning, see left half of Figure 3): Here, the first step is to analyze the impact of a crisis on the company in order to adjust the strategy. In the Covid-19 crisis, companies had to pay particular attention its suppliers (supply chain problems and rising corporate insolvencies) and customers (drop in demand and increased relevance of online activities). These demands can be used to derive consequences for the project portfolio (targets, structure, and prioritization criteria) and, where necessary, for individual projects. The next step is to update the assessment of ongoing and planned projects and even of initially deprioritized and new projects in terms of their strategic contribution, profitability, and implementation risks. With this data, the project portfolio can be analyzed, structured, reprioritized, and balanced before approving the reprioritized project portfolio. It is in this context important to consider how the crisis will affect the entire organization, e.g., when balancing resource capacities for short-time work.

- Reprioritization of an order portfolio (special case for project portfolios with a proportionally high volume of projects with external customers): In a crisis, projects are eliminated from an order portfolio or put on hold. In this case, the freed-up human resources must then be reprioritized – for internal training, concept development (innovations), or short-time work.

In current times, companies are no longer affected by a crisis just once. The number and frequency of crises are increasing, with some crises even overlapping. For this reason, it is urgently recommended for a company to agilize its project portfolio management (link to new article; to be published soon) to allow a rapid and comprehensive response to changes.